Real estate taxes are applied to residential and commercial property in order fund public infrastructures such as schools, water, roads and parks repair. Property taxes are based primarily on the assessed property value of your home or land. This can vary widely from region to region.

How to calculate your tax liability

There's no single formula that can give you an accurate estimate of your annual property tax bill, as the rate varies by region and state. Contact your local government for information.

The IRS typically charges a percentage of income to real estate agents each year. This can make it difficult to figure how much you owe. These tips and tricks can help you calculate tax more accurately.

First, you need to know how to calculate the assessed value of your property and land. This number can be found in the annual tax notice of your municipality or county, at the office of the local tax assessor or on their website.

Next, multiply that number by a rate of tax assessment and you can calculate your property taxes. The tax rate varies by jurisdiction and can range from a few mills to a percentage, like 4%.

The SmartAsset property calculator will give you an approximate estimate of your tax bill. This tool will tell you how much your property taxes will be based on the assessed value of your home, as well as any additional properties you own, including land.

How do real-estate agents pay their taxes

In addition to paying their income taxes, real estate agents are required to pay their property taxes as well. This covers both the property and personal property, including cars and boats that may be parked on the property.

A realty business is not an incorporation, so the owner must file his or her tax return every year. This can be complicated and you should consult a professional to make sure that your tax returns are correctly filed.

How to subtract expenses from real estate profits

Real estate investors have a number of ways to save money on taxes. One way is to make sure they are taking advantage of any deductions available. These can include appraisal fees, real-estate commissions, advertising expenses, and insurance.

Real estate investors can also save money on taxes by maintaining proper records. This includes documents such as business cards, receipts from purchases made for your business, and other expenses that are related to your realty career.

Moreover, real estate professionals are eligible for a number of tax benefits, including a loss deductibility for their real estate investments and an exemption from the 3.8 percent Medicare tax on unearned income. This tax break can help real estate agents and brokers earn more money while maintaining a healthy financial position.

FAQ

What amount of money can I get for my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. Zillow.com says that the average selling cost for a US house is $203,000 This

What should I do if I want to use a mortgage broker

A mortgage broker can help you find a rate that is competitive if it is important to you. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers do take a commission from lenders. Before signing up for any broker, it is important to verify the fees.

How much money should I save before buying a house?

It depends on how much time you intend to stay there. You should start saving now if you plan to stay at least five years. You don't have too much to worry about if you plan on moving in the next two years.

What should you consider when investing in real estate?

The first thing to do is ensure you have enough money to invest in real estate. You will need to borrow money from a bank if you don’t have enough cash. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

It is also important to know how much money you can afford each month for an investment property. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

Also, make sure that you have a safe area to invest in property. It is best to live elsewhere while you look at properties.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Locate Real Estate Agents

The real estate agent plays a crucial role in the market. They help people find homes, manage their properties and provide legal advice. You will find the best real estate agents with experience, knowledge and communication skills. You can look online for reviews and ask your friends and family to recommend qualified professionals. A local realtor may be able to help you with your needs.

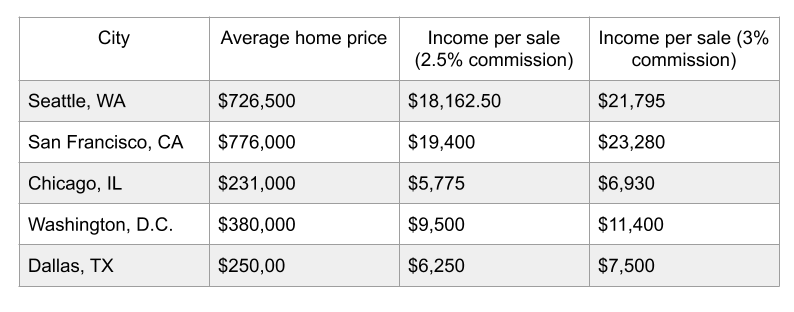

Realtors work with both buyers and sellers of residential real estate. The job of a realtor is to assist clients in buying or selling their homes. A realtor helps clients find the right house. They also help with negotiations, inspections, and coordination of closing costs. Most realtors charge commission fees based on property sale price. Unless the transaction closes, however, some realtors charge no fee.

The National Association of Realtors(r) (NAR), offers many different types of real estate agents. To become a member of NAR, licensed realtors must pass a test. To become certified, realtors must complete a course and pass an examination. NAR has established standards for accredited realtors.