Kansas has a very easy process for obtaining a real estate license. Before you can get your license, however, there are many things you should do. The pre-licensing training course is the first. You can take the course online, or in a classroom setting. The course covers basic real estate principles and information about the daily practice of a real estate agent. You also need to pass the exam.

The next step is to complete an application for your license. The broker who is licensed in Kansas must sign the application. An applicant must also include a resume. You will need to indicate whether you will be working under a supervising broker or branch broker. If you're applying to become a branch brokerage, you must show proof of your involvement in real estate for at minimum two years.

All applicants working under the supervision of a broker must submit a copy their license history. You must also submit a form to prove that you have a Kansas reciprocal real estate license if you are not a Kansas resident. You will also need to have completed the 60-hour pre-licensing education requirements.

Kansas Real Estate Commission administers and scores the exam. The exam is divided into two parts: a national and a state portion. The state portion must completed within six months after you submit the application. If you are a licensed salesperson in another jurisdiction, the state portion is not required.

The fees and supporting documentation will be required by candidates. You will have to take the exam again if you fail one section. You have 24 hours to schedule your reexam after passing the exam. You will need to pay the $82 fee for the exam.

After taking the exam, you'll receive your score reports. Within six months of receiving your score, you will need to apply to get your license. A criminal background check will be required if you have a criminal past. You will also need to fill out the Offense Reporting Form. Your fingerprint cards will also be required. The licensing exam centers can issue fingerprint cards.

The Kansas Real Estate Commission will then review the background report. If there are any issues, they will make disciplinary decisions. Sometimes, a license may not be granted. A license may be denied to someone with a criminal or financial record. Your license may be suspended or revoked.

License requirements are detailed at the Kansas Real Estate Commission. Their website has more information. You will need to have a high school diploma, and you must be at least 18 years old. A Kansas licensed broker must supervise you.

FAQ

What should you consider when investing in real estate?

It is important to ensure that you have enough money in order to invest your money in real estate. You can borrow money from a bank or financial institution if you don't have enough money. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

Also, you need to be aware of how much you can invest in an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be a good idea to live somewhere else while looking for properties.

Can I get a second loan?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What can I do to fix my roof?

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. Contact us for further information.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

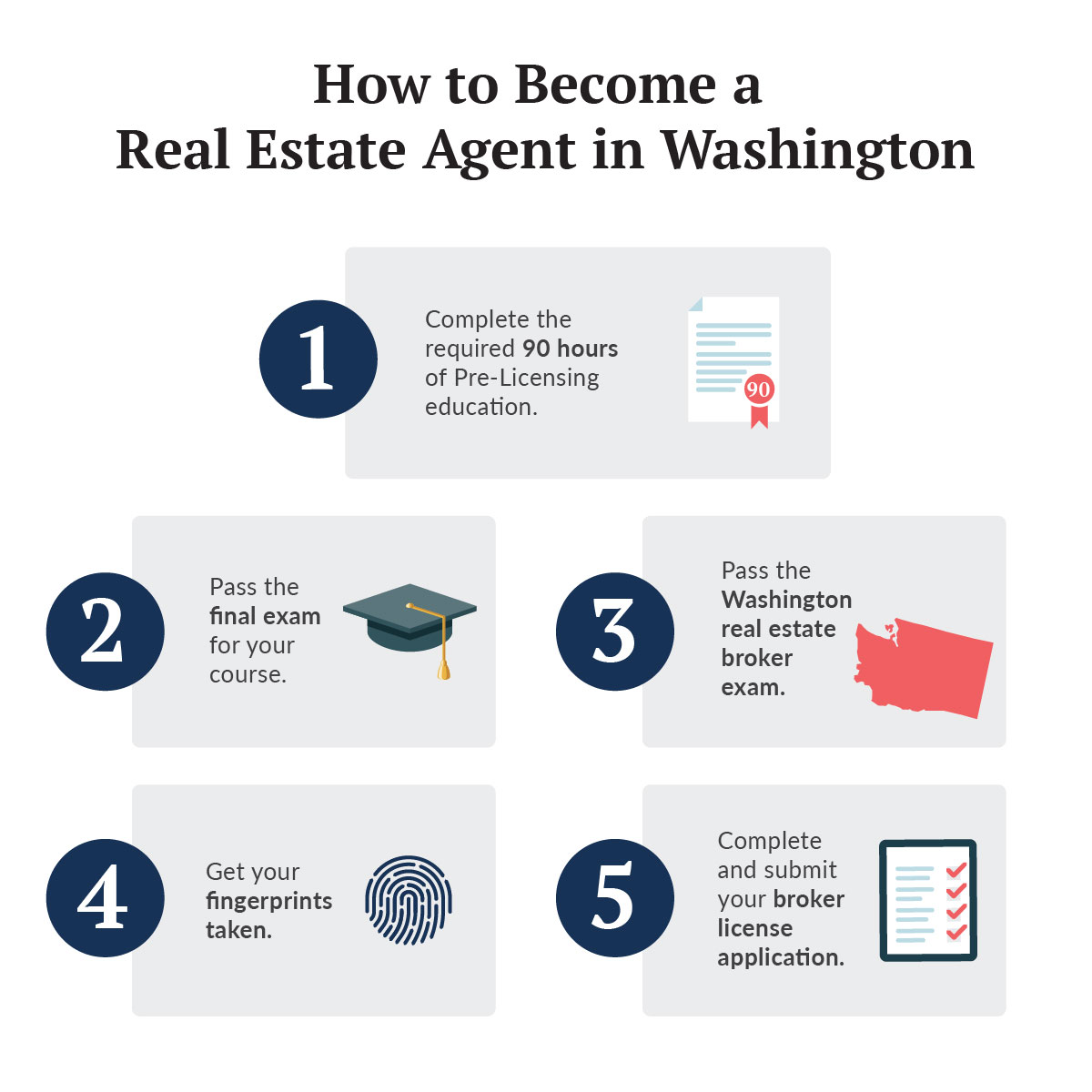

How to be a real-estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!