Real estate investment is a smart choice for anyone who wants to boost their equity or make extra money. It has many benefits including recurring earnings, tax breaks, and appreciation. But before you start investing in real estate, it's important to weigh the pros and cons of this type of investment to determine if it's right for you.

Perks to being a Real Estate Agent

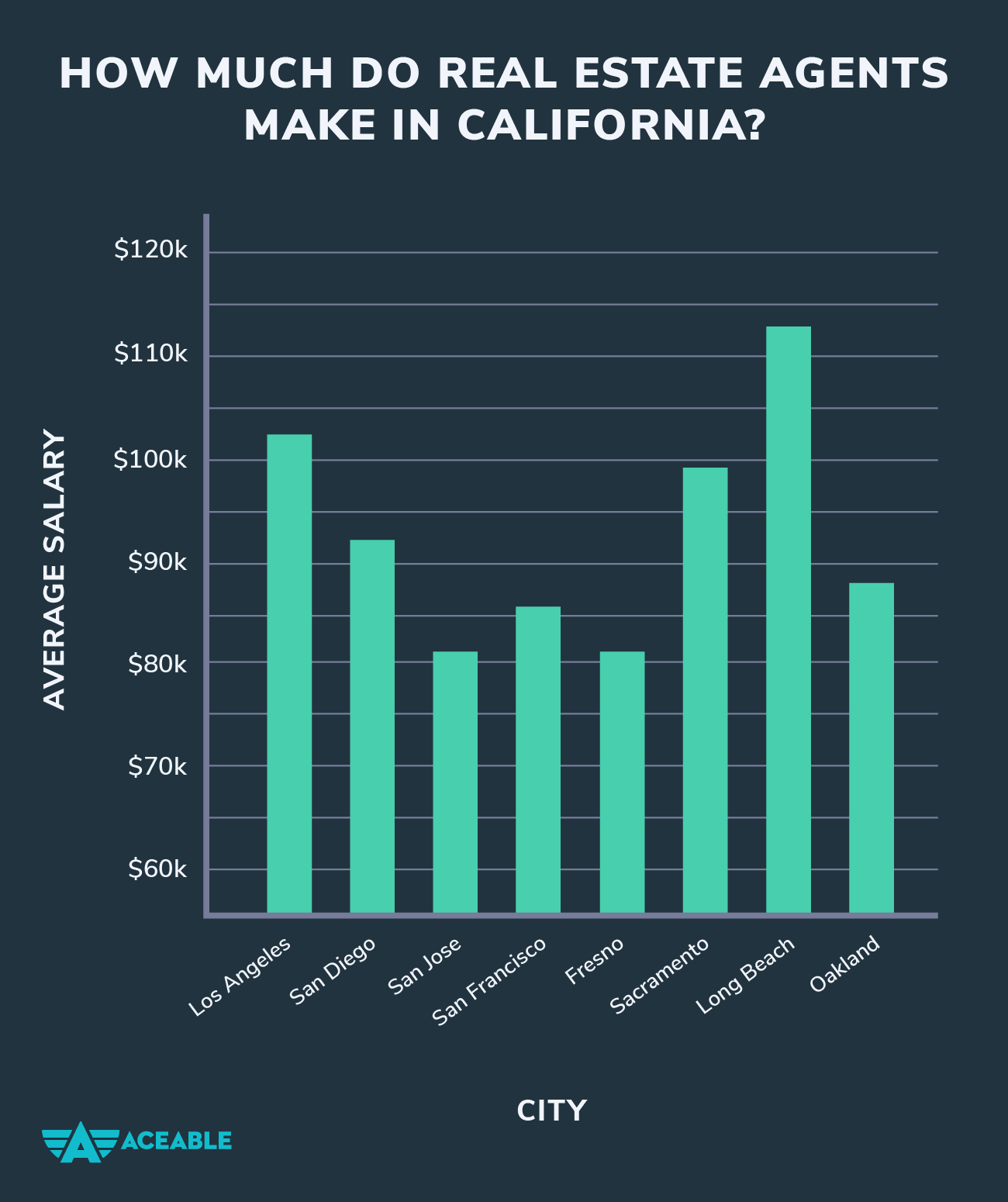

Real estate careers can be rewarding and exciting for those who like working with people and enjoy helping them find homes or property to invest in. It can also be a lucrative profession, and you could earn substantial commissions.

It's possible to work remotely, allowing you to choose your own schedule. You can work whenever you like. It can be a great benefit for some people as they get to spend more time at home with their families and have less stress.

The career in real estate can be a great way to make money, especially if you're willing to put in the effort to stay up-to-date on current trends and market conditions. It is important to distinguish yourself from other real estate agents if you wish to become known in the area and attract people who are looking to purchase or sell property.

It's not easy to get into the real estate industry. You should carefully consider whether this is right for you. Before you make your decision, it's vital to research the field and receive the support that you need.

You can build your reputation in the industry as a real estate expert by choosing a career. You'll be able to develop your own brand, and this can be an important part of your career development and personal success.

You can gain a variety of skills including dealing with buyers, sellers, negotiating contracts, managing property, and handling the paperwork. You'll need a thorough understanding of all the laws that govern this field.

Real estate is an excellent investment, especially for those with the drive and determination to succeed. It is a way to become involved in your community and establish a lasting reputation.

It's hard to tell if the stock market is rising or falling, and it may take a while for your investment to become profitable. Doing your research and being diligent can increase the worth of your investments in real estate, boosting your cash flow.

FAQ

Is it possible sell a house quickly?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. Before you sell your house, however, there are a few things that you should remember. First, find a buyer for your house and then negotiate a contract. You must prepare your home for sale. Third, you must advertise your property. You must also accept any offers that are made to you.

What is the maximum number of times I can refinance my mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. You can typically refinance once every five year in either case.

Which is better, to rent or buy?

Renting is usually cheaper than buying a house. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. You also have the advantage of owning a home. You will be able to have greater control over your life.

Can I get a second loan?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How do I know if my house is worth selling?

You may have an asking price too low because your home was not priced correctly. Your asking price should be well below the market value to ensure that there is enough interest in your property. For more information on current market conditions, download our Home Value Report.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to become an agent in real estate

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This involves studying for at least 2 hours per day over a period of 3 months.

You are now ready to take your final exam. To become a realty agent, you must score at minimum 80%.

All these exams must be passed before you can become a licensed real estate agent.