New York is home to a booming real estate industry, with many opportunities for real estate agents. To make the most out your career as a real-estate agent in New York you must have a license.

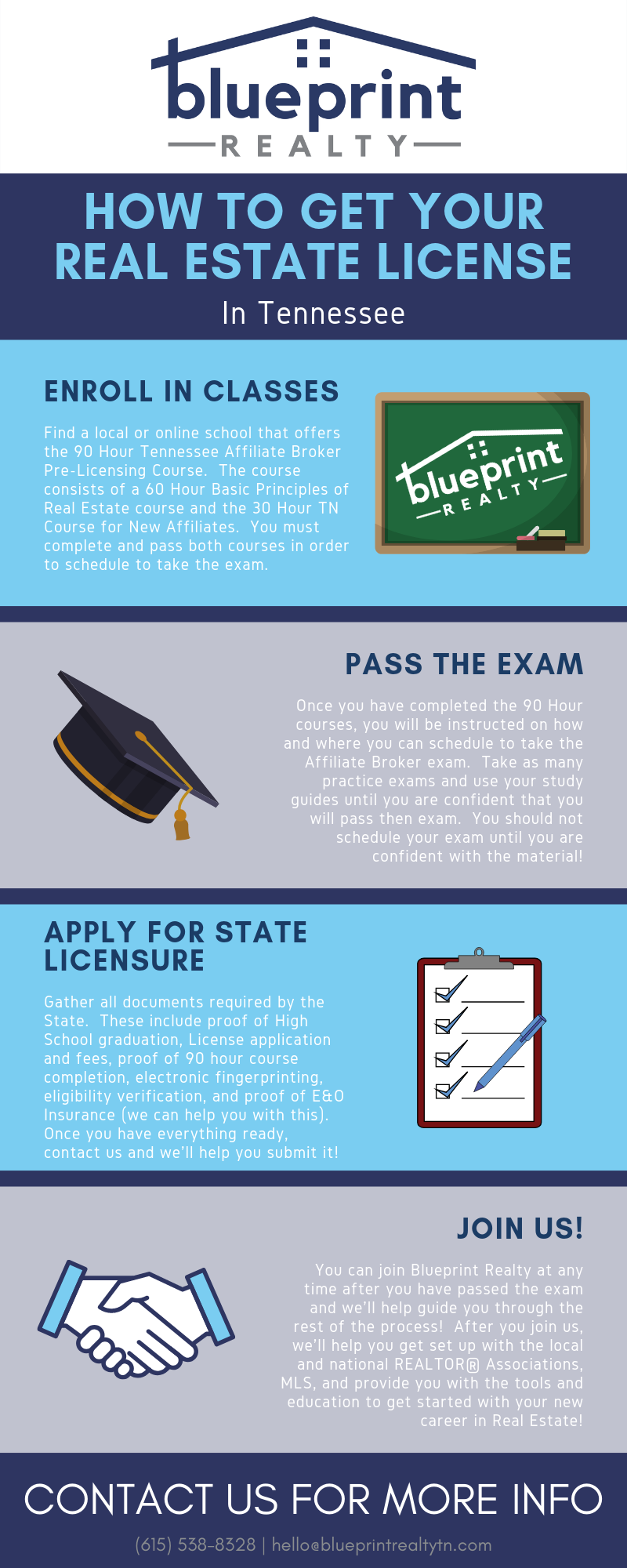

First, complete the 75 hour pre-licensing course. This can be completed through a real estate school in your area or online. You will need to pass a final exam in order to complete the course and get your New York real estate license.

How to become a real estate agent in New York

The time it takes to become an agent for real estate can range from three months all the way up until three years. How much time you are willing to spend on the educational process, and how well your study, will determine how fast you complete it. You can finish your education quickly if you put in the work.

Get Your Real Estate License In NY

The licensing process is fairly simple for new York residents. Before applying for your license you must be of legal age, complete the 75-hour prelicensing class, pass the exam and have had at least 2 years experience in sales. This requirement can be met by using your prior education and work experience as a salesperson, or in a similar field.

How to Get a Broker License New York

To become a licensed broker, you'll need a broker sponsor. This individual will provide you guidance and mentorship during your tenure as a realtor. You will receive marketing materials and leads to help you get started in your new career.

How to Get a Real Estate Broker License New York

Once you've completed your pre-licensing 75-hour coursework and passed the test, it's finally time to look for a brokerage. It is important to choose a broker who has a solid reputation and is known for their ability to hire and train agents. Ask about the commission structure of their brokerage and what benefits they provide to their agents.

Get Your New York Real Estate License

New York State's Broker Examination must be passed to continue the real estate licensing process. This exam can be taken in-person or proctored online and is required by law. Register for the exam using eAccessNY. This is the licensing management system of the New York Department of State.

How to Pass New York Real Estate Broker Examination

New York State's broker exam is 120 multiple choice questions. The exam should take at least two and a half to three hours.

How to Get the New York Realtor License. The New York Realtor License is a difficult exam to pass, but the rewards are worth the struggle. A career in the real estate industry can be a great way to earn a nice salary while having an interesting and fulfilling job. You can earn some money on your own while taking a career-break or spending time with your family.

FAQ

Is it possible to sell a house fast?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. But there are some important things you need to know before selling your house. First, find a buyer for your house and then negotiate a contract. The second step is to prepare your house for selling. Third, you must advertise your property. Lastly, you must accept any offers you receive.

What should you consider when investing in real estate?

First, ensure that you have enough cash to invest in real property. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You must also be clear about how much you have to spend on your investment property each monthly. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

You must also ensure that your investment property is secure. It is best to live elsewhere while you look at properties.

What are the benefits associated with a fixed mortgage rate?

A fixed-rate mortgage locks in your interest rate for the term of the loan. This will ensure that there are no rising interest rates. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

Is it possible to get a second mortgage?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

What should I look for when choosing a mortgage broker

Mortgage brokers help people who may not be eligible for traditional mortgages. They search through lenders to find the right deal for their clients. Some brokers charge fees for this service. Other brokers offer no-cost services.

What should I do if I want to use a mortgage broker

Consider a mortgage broker if you want to get a better rate. Brokers are able to work with multiple lenders and help you negotiate the best rate. Brokers may receive commissions from lenders. Before you sign up, be sure to review all fees associated.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to buy a mobile house

Mobile homes are houses constructed on wheels and towed behind a vehicle. They were first used by soldiers after they lost their homes during World War II. Today, mobile homes are also used by people who want to live out of town. These homes are available in many sizes and styles. Some houses are small while others can hold multiple families. There are some even made just for pets.

There are two types of mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This happens before the product can be delivered to the customer. Another option is to build your own mobile home yourself. Decide the size and features you require. You'll also need to make sure that you have enough materials to construct your house. Final, you'll need permits to construct your new home.

If you plan to purchase a mobile home, there are three things you should keep in mind. Because you won't always be able to access a garage, you might consider choosing a model with more space. A larger living space is a good option if you plan to move in to your home immediately. You should also inspect the trailer. You could have problems down the road if you damage any parts of the frame.

Before buying a mobile home, you should know how much you can spend. It is important to compare the prices of different models and manufacturers. It is important to inspect the condition of trailers. While many dealers offer financing options for their customers, the interest rates charged by lenders can vary widely depending on which lender they are.

You can also rent a mobile home instead of purchasing one. You can test drive a particular model by renting it instead of buying one. Renting is expensive. The average renter pays around $300 per monthly.