There are many things and options to consider when thinking about purchasing a house. Save for the downpayment, locate a house in a great school district, and check that the house is in good repair. You'll also want to look at the neighborhood's culture and local businesses. Lastly, make sure that the mortgage payment is something you can comfortably afford. The last thing you want is to buy a home that's too expensive for you.

For a down payment, save money

FDIC insured savings accounts are the best option for saving money to pay down a home purchase. These accounts offer higher interest rates than average and easy access. For those who are planning to buy a long-term home, it may be more practical to invest in the market. The potential for higher returns can make sense.

Start by calculating what your income is. Find out how much money your monthly income is and add the income of your partner, if any. You can review your bank statements or credit card bills.

Locating a house in an area with good schools

The location of a school is an important factor in buying a home. However, it is not the only thing that is important. Other factors such as commute time and school standards can also be important. It is important to reflect on all of these aspects and be willing to make sacrifices.

First of all, if you're buying a house for yourself or for a family, finding a house in a good school district will increase the resale value of the property and make it easier to sell. Second, if you're considering buying a house for your children, a good school district will give them the best education. Special provisions may be made available for students with special needs in some school districts.

A home inspection

Getting a home inspection before you buy a house is important for a variety of reasons. It can give you a sense that you own the house and help you negotiate a fair price. A well-maintained home will usually be worth closing on. But, if the property is in dire need of work, an inspector's report may help you to negotiate a price or convince the seller that the problem can be fixed.

You may be able to negotiate with the seller to repair or lower the price if a home inspection uncovers significant issues, such as a leaking water heater. You can also opt out of the deal and pay the repair costs. Often, the seller will agree for a home examination as part of the contract.

FAQ

What amount of money can I get for my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. Zillow.com shows that the average home sells for $203,000 in the US. This

Should I rent or purchase a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting allows you to avoid paying maintenance fees and other monthly charges. The condo you buy gives you the right to use the unit. You can use the space as you see fit.

What is the average time it takes to get a mortgage approval?

It depends on several factors such as credit score, income level, type of loan, etc. Generally speaking, it takes around 30 days to get a mortgage approved.

Do I need a mortgage broker?

A mortgage broker is a good choice if you're looking for a low rate. Brokers can negotiate deals for you with multiple lenders. Some brokers earn a commission from the lender. You should check out all the fees associated with a particular broker before signing up.

How do I eliminate termites and other pests?

Your home will be destroyed by termites and other pests over time. They can cause severe damage to wooden structures, such as decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

How do you calculate your interest rate?

Market conditions can affect how interest rates change each day. The average interest rate over the past week was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What is a reverse loan?

A reverse mortgage lets you borrow money directly from your home. It allows you to borrow money from your home while still living in it. There are two types available: FHA (government-insured) and conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance covers the repayment.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

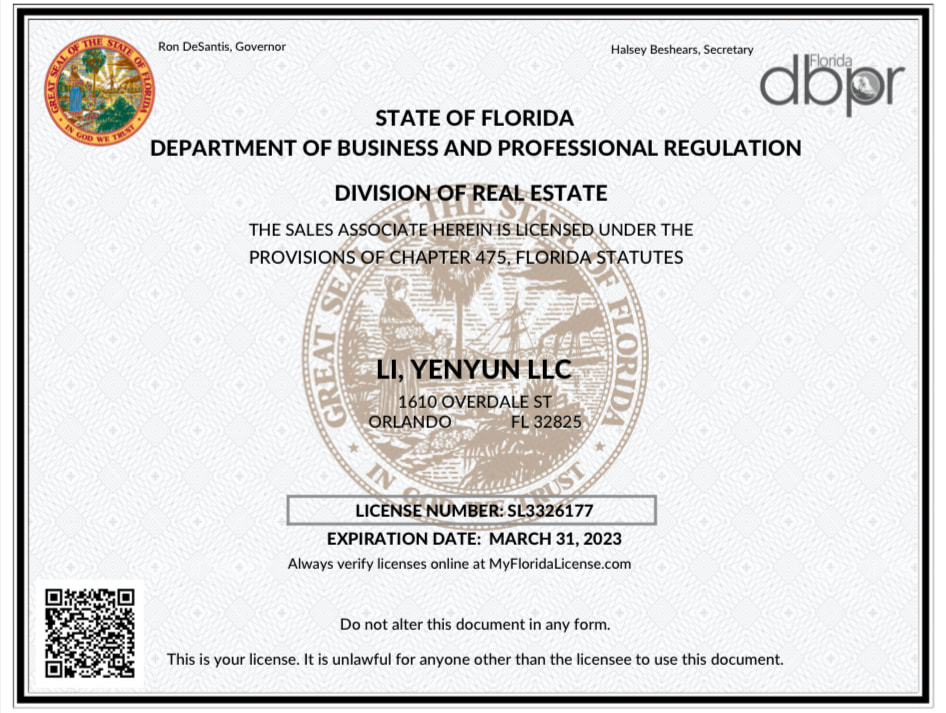

How to be a real-estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

Once this is complete, you are ready to take the final exam. In order to become a real estate agent, your score must be at least 80%.

All these exams must be passed before you can become a licensed real estate agent.