You might be interested in diversifying your portfolio by investing in real estate. Real estate investing is a great choice for many reasons. Real estate investment offers many benefits, including high returns. However, there are also many pitfalls to avoid. Real estate can be risky. You also need to maintain your property and have insurance. This article outlines the steps you should take to ensure you avoid the most common pitfalls. It also provides a guide for beginners looking to diversify their portfolio.

Real estate investments are a good way for diversification in your investment portfolio.

Real estate investing can be a great way of diversifying your portfolio and avoiding high-risk investments. Real estate is a great way for you to diversify and make cashflow from rental properties and appreciation of your property. You can also enjoy substantial capital gains and capital gains throughout your retirement years. It is not for everyone but those who want to minimize risk and maximize their returns can make real estate investments.

Real estate has a low correlation with other assets, such as stocks and bonds. It typically rises or falls after the rest. Each market is unique and factors that lower the value of homes in one area may not affect them in another. CFP Daniel Kern from TFC Financial Management Boston says that real estate should be a part of at least five percent to ten percent of your overall investment portfolio.

It is a wise financial investment

Real estate can be a viable option for diversifying your portfolio. Because it has little to no correlation with the stock exchange, many investors think it is a wise decision to reduce overall loss. You should remember that there is no sure thing and there may be significant losses. This article will cover the main benefits to investing in real-estate. This article will also give an overview about the various types of real estate and offer a few investment strategies.

Real estate is a bankable asset that can generate a steady stream income. The property's actual value can be used to finance your loan. This means that you don’t need to invest a lot of money upfront. You can also use bank money to increase your investment. You can take advantage of low interest rates which are like having free money. Real estate investments can provide tax benefits.

It takes a team.

It is important to have the right professionals working with you when building a team for real estate ventures. Perform thorough due diligence on every potential team member before hiring. Ask for recommendations and contact references if you can. You should also know your market, niche and strategy in order to get the best from your real estate team. A team that works well together is key to your success.

Real estate investing requires a legal counsel. They will ensure that all paperwork is correct and that evictions are done in accordance with the law. For financial management and bookkeeping, you will need an experienced bookkeeper in real estate investment. It is also important to have a marketing coordinator. Finally, a team is crucial for any successful real estate investing company.

You have many options.

There are many methods to invest in real estate. To purchase property, some people invest their own capital. Others may pool funds. Depending upon your goals, you may buy or rent houses. Or, you could use money from others to renovate properties. You can either make a profit or lose money on your investment. Here are some methods to invest in real estate. These strategies offer varying degrees of difficulty and reward.

You can buy a house to fix up, then sell it for a higher price. This is one of the most popular ways to invest real estate. While this strategy is most lucrative, it can also be costly and time-consuming. Real estate investing is a great way to start the game if you have the time and patience. You can also invest multiple properties in one transaction and make a substantial profit.

FAQ

Is it better buy or rent?

Renting is usually cheaper than buying a house. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. There are many benefits to buying a home. You'll have greater control over your living environment.

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It works by allowing you to draw down funds from your home equity while still living there. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers your repayments.

What should I do if I want to use a mortgage broker

Consider a mortgage broker if you want to get a better rate. A broker works with multiple lenders to negotiate your behalf. Some brokers receive a commission from lenders. You should check out all the fees associated with a particular broker before signing up.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to become real estate broker

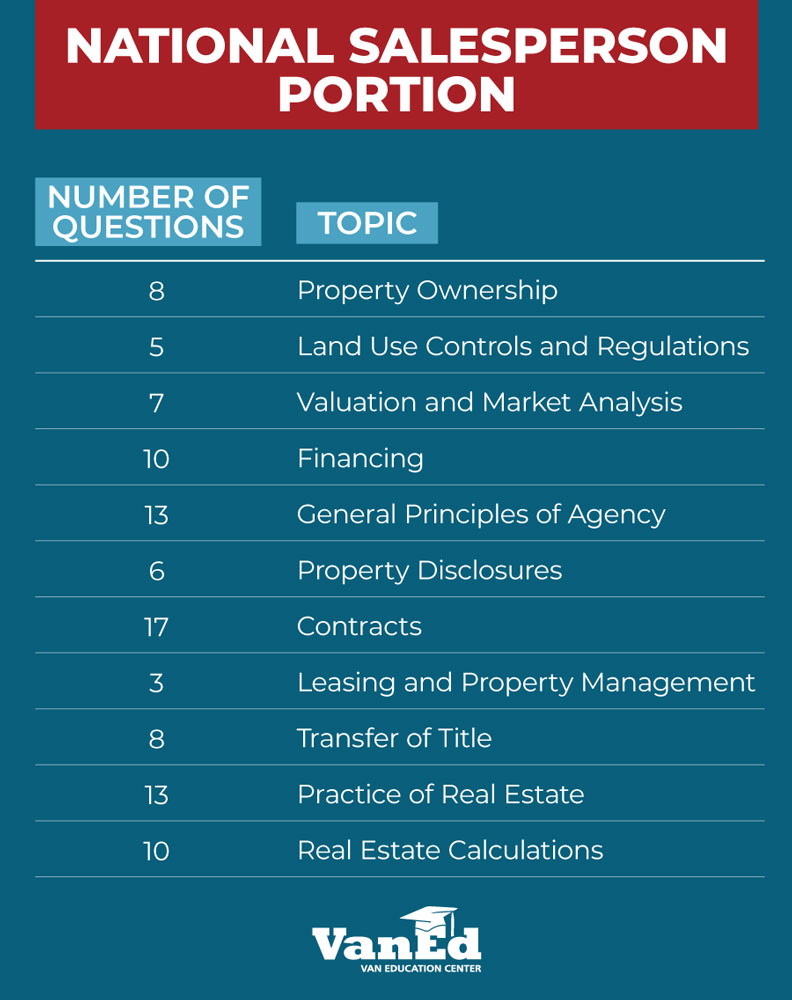

You must first take an introductory course to become a licensed real estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires that you study for at most 2 hours per days over 3 months.

After passing the exam, you can take the final one. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

If you pass all these exams, then you are now qualified to start working as a real estate agent!